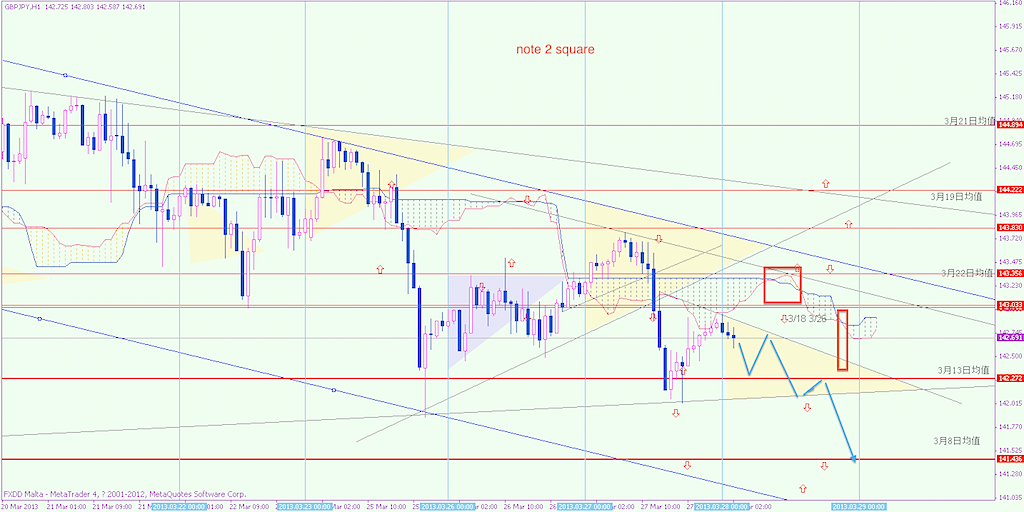

This is success week that done well trade on the plan.I had 1 short +30pips for EJ and one short in down from H1 SPANB at last closed it with +110pips at 142.1 yesterday. This is the same position as the day before yesterday, same in same close. We know there is always repeat the history, so as trading market because it is human’s working. Now I owen a short in at my [Head Down](缩头) signal before Tokyo market time.

I would close my any order speedily because tomorrow is GoodDay and today is C-Day in Ichimoku Time Theory. As we know, In my cause, I had shared my experience with middle wave about the it is always start from S day and end to the S’ day. When s wave was happened, we always could find the S line and the price would be return to it at the Basic Number C-Day.Now, today is 1 period 2 section C-Day from 1/30 and the price is return to 142.75. So we can use the S line just like a average line to long or short.

142.75 is 3/18’s Tokyo Asi’s average price line, and Triangle Shears is point to down. So I can keep a twice HeadDown signal and wait the trade line is braked.

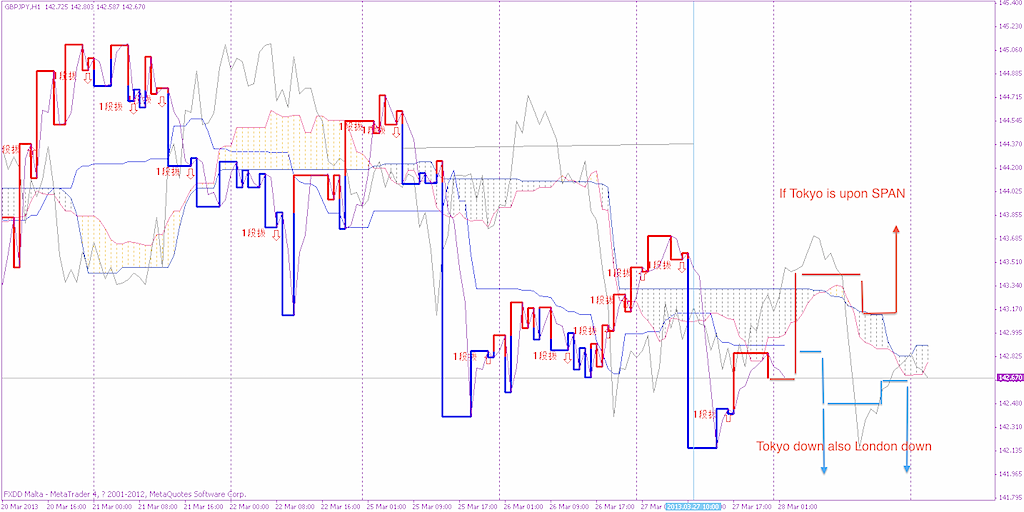

There are 2 Kumo Tenkan(云捻) in H1.So if Tokyo market has enough power to up and break out of H1 kumo, and pass to London slowly safely, there will be up from that time, then the price is break out from the down tunnel to up.

And we can plan another way.Tokyo and London is both down then we should short it nearby S line, Don’t forget the S Line.Today’s price will through it again and again .