In the open cause I told a story about Korea War with some candlesticks. We all know Japanese Candlesticks is very useful when we do some trading and we can make some judge in some pattern with candlesticks group. Originally, Japanese trader made no use for Japanese Candlesticks and they were affected by some methods later. Of cause, it is the most famous which called Saketa’s five methods.

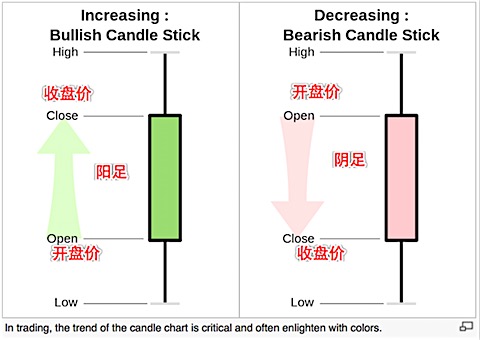

But in forex, the market is inseparable so that we divide it at each 24 hours to one candlesticks with not naturally even division it to one minute or one second. We know Ichimoku Kinkouhyou is builded base on Candle Stick, so it’s all lines are defined in four elements which make up of candle stick. There are Open price, Close price, High price and Low price.[In the group we call it HCOL].

In trading, we often use two colors to different the candle chart or Yin and Yang in Chinese. When Close price is higher than Open price we call it Yang and color it in green(safe), and Yin is called and colored with red(danger) when Close price is lower than Open price. And in trading, also always change so this four elements bring the market change to display it with that they make Body what is drawled in square and Shadow in line. And we need handle the mean what behind the candlestick.

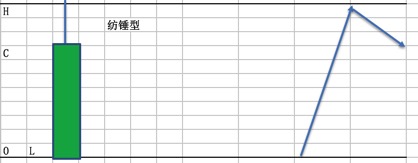

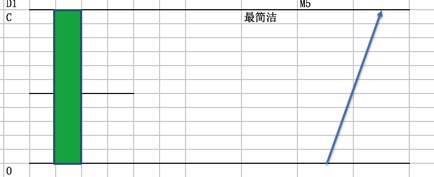

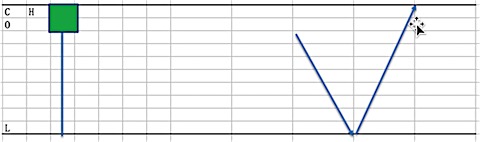

Let us see the simple sample which is called by YangAsi . This candle stick’s open price is equals with the low price and the close price is equals with the high price.

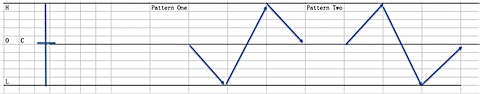

So if it is appeared in Day chart and we could see it is a wave (I Wave in Ichimoku Kinkouhyou) in Minute 5 chart, also the other compact wave may be displayed but the I wave is the best simple wave.

Sample 1: Big Yang Asi

Sample 1: Big Yang Asi

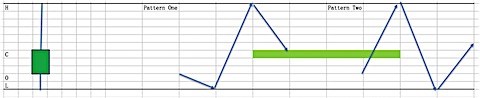

At sample 2, we can see it is compacted with a long I wave and small down wave that became to a small up shadow. Also this means the market is still on up way.

At sample 3, a long up shadow is caused in one strong down I wave after a up I wave. It means maybe go to down way later.

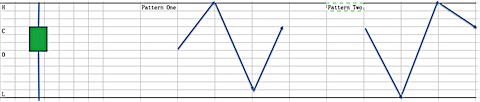

At sample 4, this is middle way, it could not judge up or down way, so it is seen the small balance. We can see there are two patterns of N wave, so it needs analysis in two way base the passed candle stick.

Sample 4:Both shadow with big body

Sample 4:Both shadow with big body

At sample 5, as sample 4, but it means a strong up I wave after a down I wave and it may be continue up way cause the small body. Sample 5:Both shadow with small body and long down shadow

Sample 5:Both shadow with small body and long down shadow

If the candle stick with a long down shadow, it means a strong up way as sample 6. Sample 6: With long down shadow

Sample 6: With long down shadow

Different as sample 5, two patterns in N wave and it means down way is stronger than up way.

Sample 7: Both shadow with long up shadow

Sample 7: Both shadow with long up shadow

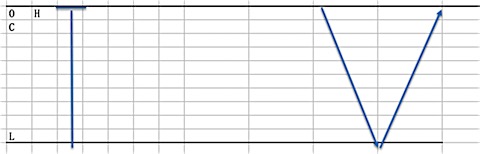

At sample 8, the open price is equals with close price as highest, so this is clear in V wave and there will be strong up way.  Sample 8: Up line with long down shadow

Sample 8: Up line with long down shadow

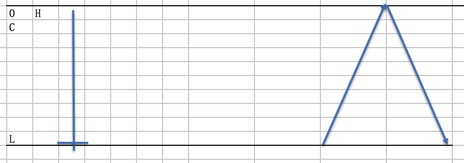

It is the other way to around as sample 8, and there is strong down way. Sample 9: Down line with long up shadow

Sample 9: Down line with long up shadow

At last sample, this is one cycle with N wave. It will be changed to different way with the passes candle stick. If the passed is Yin Asi, after the cross star, it will be Yang Asi.  Sample 10: cross star.

Sample 10: cross star.

In Ichimoku kinkouhyou, It is the greatest method that it could be calculated for the first N wave.So we need know the wave pattern which behind candlestick could be and handle it to take the wave target.