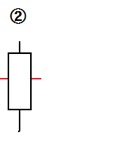

羽黑第2号线经常出现。属于大阳线,且实体部分是重合在中心线上的。Haguro’s the second line is always displayed, it is big Yang Asi and the body is on the center line.

a:在长期上升后出现第2号线的场合,下一周如果盘踞在

a:在长期上升后出现第2号线的场合,下一周如果盘踞在

高位时,可以空;甚至在跌到中心线以后,更可以趁势追击补空仓。

The basic way is: when the second line is displayed after long up trending, if the price is near by the higher price it could be trading on sale also the trending is down of center line it could add more sale order.

b:在多底中间波动时候出现实体部分比较短小的线的场合,意味着上升的兆头可以买入。

On double or third bottles, when the second line with small short body is displayed, it is a sign for buy.

c:下周,开盘跳空的场合,可以空仓卖出。

It can be sale when the open price jumped low window next week.

d:连续2周出现第2号线的场合,意味着上升势力强劲可以加仓买入。

If the second line is continues displayed twice, it means you can add buy trading.

e:连续3周出现第2号线的场合,在回调处买入可以吃到小幅的利益。

If the second line is continues displayed three times, you can buy and get some short target after return.

f:连续4周出现第2号线的场合,在暴涨的时候空。

If the second line is continues displayed four times, you can sale after the price is rocketing.

d和e是我挂在嘴上的【美味第三波,鸡肋第五波,乏味第七波,不知所措第九波】中第三波和第五波的表现。f是第九波时候的表现。近来在关注纽元。8月纽元出现一次暴跌之后,慢慢地进入回调,现在关注看它第一波动是否能够成立。看看周足。9月23日那一周出现的是9号线,紧接着2号线,本周又一次2号线。暗示下周观察开盘,如果高开则趁势做空,价格回到中间线后趁机加码。

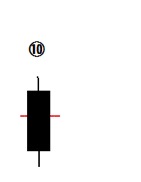

与第2号线相反的就是第10号线了。这是实体部分和中心线重合的大阴线. Instead, the tenth line is a big Yin Asi with big body on the center line.

其基本战略思想是,

a:当下周开盘价在收盘价和中心线之间,此后往最低价走的时候可以空。

After next week’s open price is between in the close and the center line, and go to low price, may take sale trading.

b:当前周是长长的大阳线的时候,需要爆买。

If the before week’s candlestick is a long and big Yang Asi , you need buy and buy.

在多底中间波动出现的场合,On double or third bottles,

c:当下周开盘价低于中心线以下,此后上升突破中心线和最高价以后可以买入。

After next week’s open price is down of the center line, and you can buy trading when the price is freaked the center line even the high price.

d:前周周足又长又大,和本周构成孕育线,意味着需要强烈买入。

If the before week’s candlestick was longer and bigger, it means strong buy trading.