In my collections, there are five original books but we always can only see just one book to explain Ichimoku just as which is written by Nicole Elliot. So how is possible that transaction into one English book from five Japanese books?

So we could believe that is someone did not know more of Ichimoku or you can say there are too empty words in the original books.

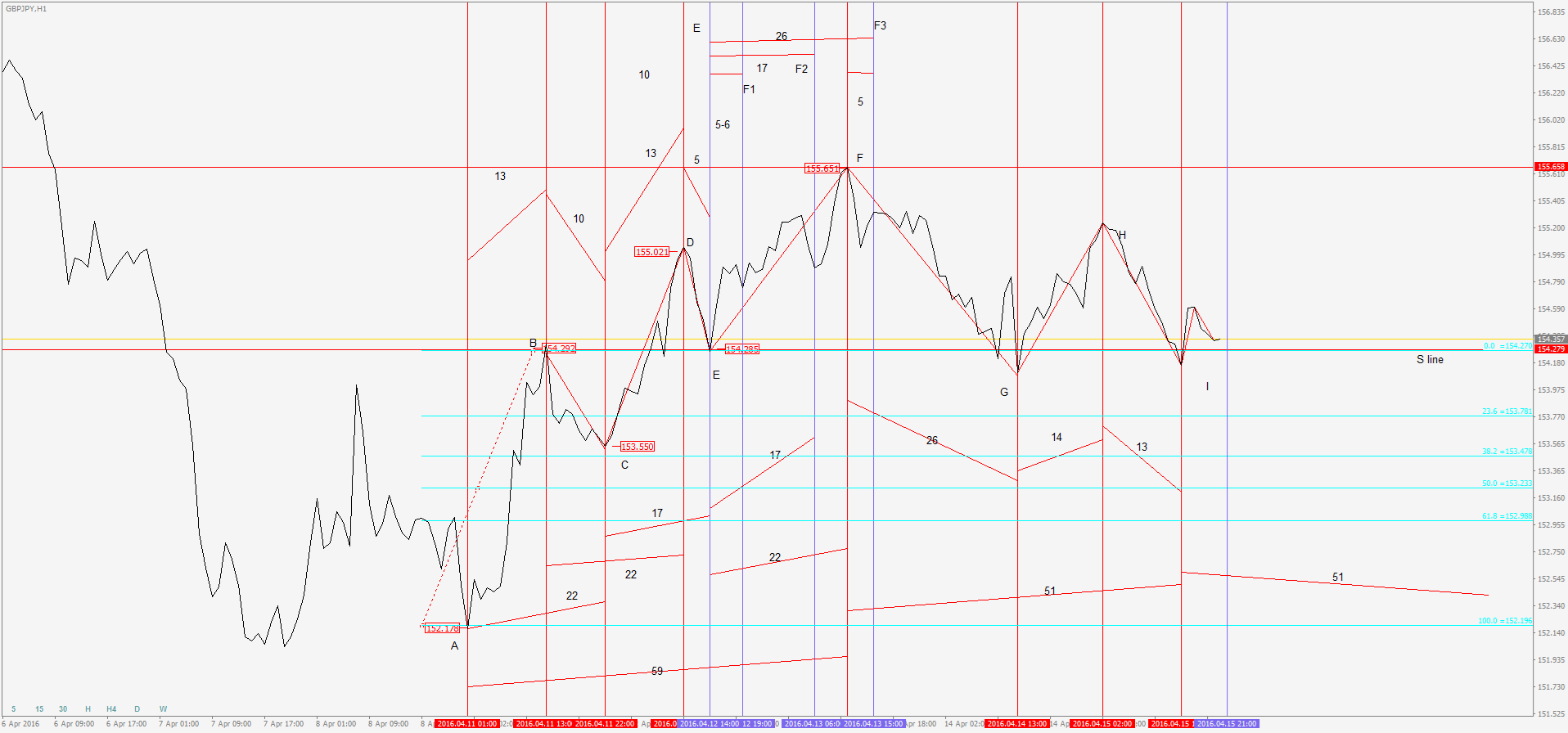

I always teach my students with using one symbol case to explain the Ichimoku’s three theories also in this year’s seminar. Continue last week, we had studied one perfect case of USDJPY H1, then we met a wonderful case of GBPJPY H1 too.

So, I did let one member try to explain this case use Chinese and I would do some explain in this blog.

Now, let’s check this H1 chart of GBPJPY which was happened in last week.

Before point A, there is a V wave to come back to one low price and stopped a down way. Until point C is appeared, we could not judge this will be a up way from A to B then to C. When the price is stopped BC’s back and turn to up, and now we focus in it.

At first, we can check the candle’s number between A to B, it is 13. And from B to C is 10 which is nearby the basic number 9. We know there are three time patterns with N wave. They are AB = CD, BC= CD and AC= CD.

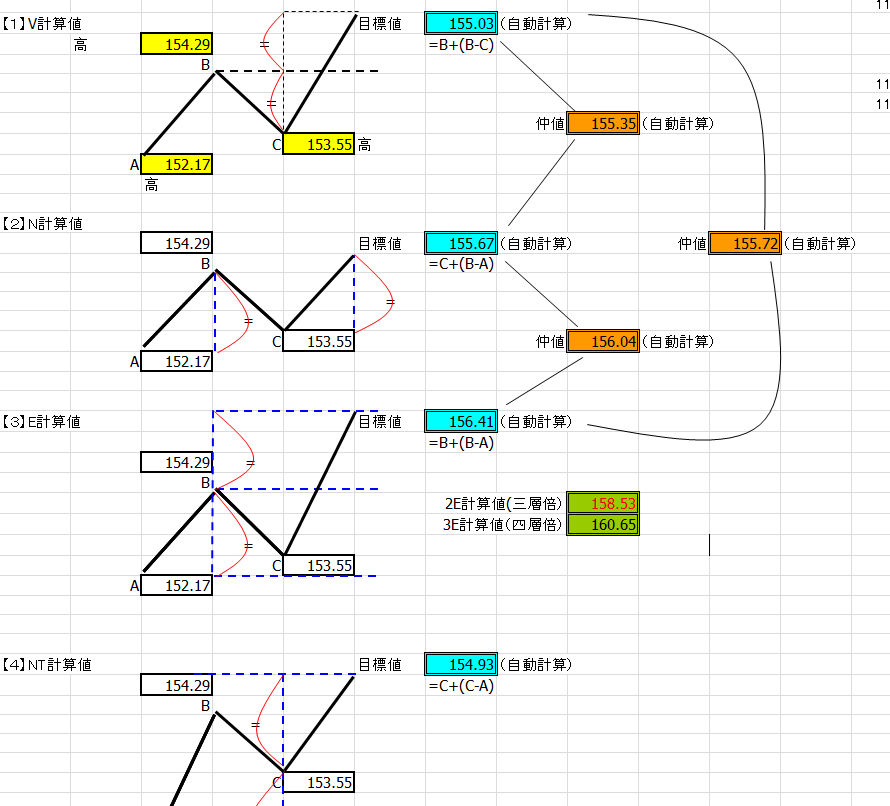

In time theory, AB = CD pattern is a repeat cycle; the other patterns are mirror symmetry. If we do some buy trades, you can guess you could hold this order until point D will be arrived which point is maybe 10 or 13 later after point C, and the target level will be as follow calculation.

In fact, we are so happy that the point is arrived at 155.02 which is nearby V price target. But this is not amazing thing, we should wonder why the price target is not N price target, because the point C is just return back at about Fibonacci’s 38.2% and not low than 50%, so it is still strong to go to buy way.

After 5 candles later when E point is appeared, we could judge there will be the second N wave’s up way where would go to CDEF. Just use same think way, after the point E, there will be F1 is after 5 candles and F2 is after 17 candles and F3 is after 26 candles. We do believe there will be go to N price target in this three points and it is really arrived at point F which is 22 candles later after point E. But now we could noticed the number 22 is repeat 3 times at least. They are AC=BD=EF, and the price of point F is 155.65 which is nearby N price target!

This is amazing!

After point F, there is I = V pattern [FG = GHI] which is constituted by 26 = 14+13 -1.

In the future, we should get the point will be at 13 candles later and 26 candles later.

Great artical, more please 🙂

So beautiful!

I sehaercd a bunch of sites and this was the best.

much more enlightening, great job, thanks and cheers